Research institutional investors rely on

Professional valuation models, three-scenario analysis, and primary research through channel checks with customers, competitors, and experts. We uncover dynamics before the market does.

Get direct access to analysts and company management + structured analysis on 146 Nordic growth companies—with our Quality-First Framework, insider signals, and analyst team insights most investors never see.

Contact us

Professional valuation models, three-scenario analysis, and primary research through channel checks with customers, competitors, and experts. We uncover dynamics before the market does.

Direct analyst contact, facilitated management meetings at 146 companies, and 100+ annual events including our exclusive Serial Acquirers Club.

Quality Rating filters, Top Picks portfolio, ownership analytics, momentum data, and short interest tracking in one integrated platform.

“Redeye are different to other research providers. They are truly long-term focused and think like investors.”

Andrew Strasser, Investment Analyst at Constantia Investment Partners, Australia

Our analysts don't rely on consensus estimates or surface-level metrics. We systematically evaluate what truly drives long-term returns—management quality, competitive moats, and financial durability. This disciplined approach consistently identifies opportunities before they're priced in.

Our systematic approach evaluates 100+ factors across three pillars. Management quality, compensation alignment, innovation capacity, balance sheet health, competitive positioning—nothing escapes our checklist.

Our analysts conduct field research: customer interviews, supplier checks, competitor analysis, industry expert consultations. We piece together non-material information to form material conclusions before the market catches on.

Scenario-based DCF, peer analysis, and sum-of-the-parts models for every company. Three distinct outcomes help you understand risk-reward with precision.

→

Full research archive on all 146 covered companies

→

Proprietary Quality Rating (People, Business, Financials)

→

Quarterly theme reports (Serial Acquirers, SaaS, IT Consulting)

→

Annual sector outlooks (Gaming, Cybersecurity, Life Science)

→

Same-day earnings notes + next-day deep updates

→

Analyst contact for your research questions

→

Corporate access to management teams

→

Priority invitations to in-person conferences

→

Exclusive Serial Acquirers Club membership

→

Priority customer support

→

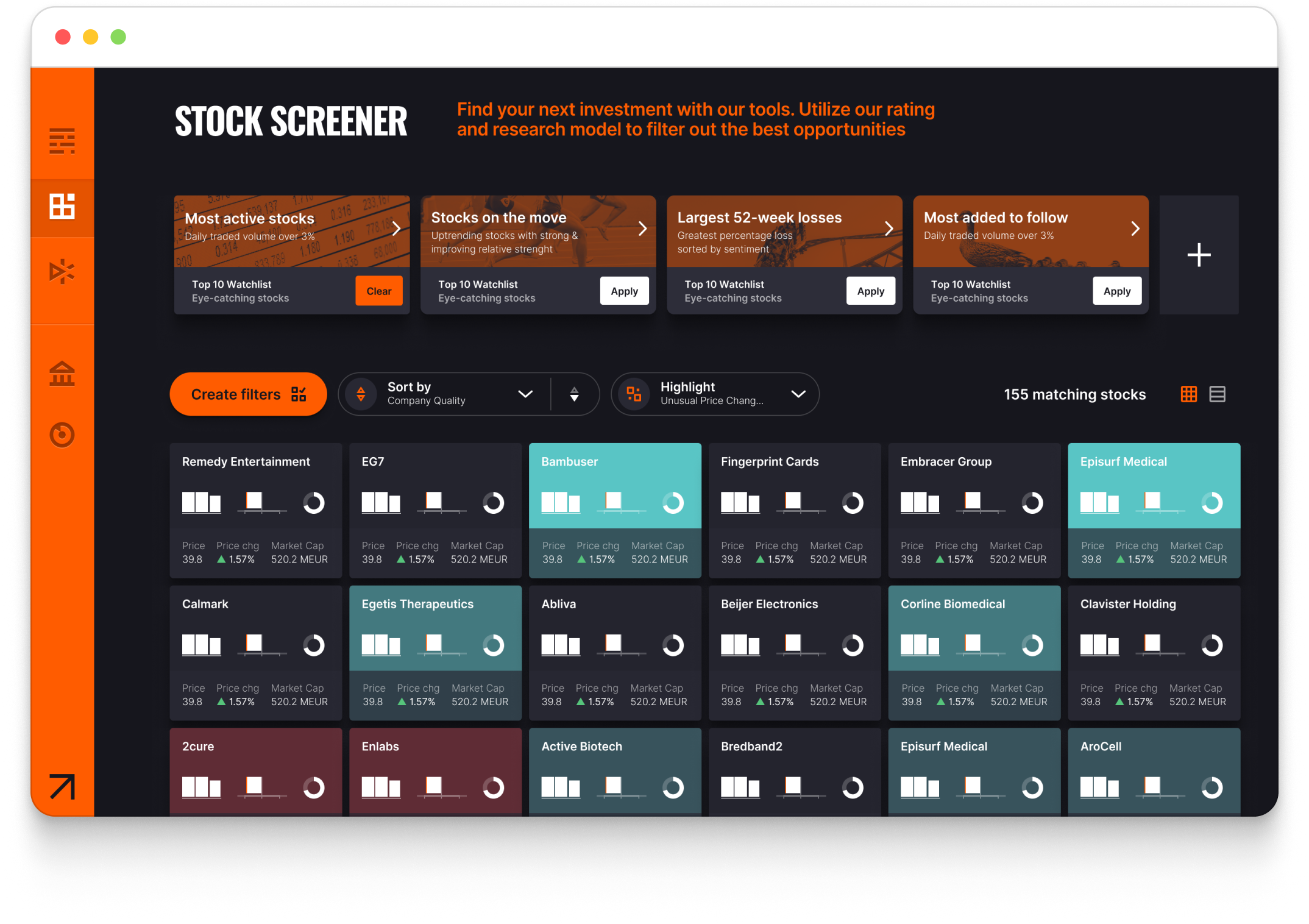

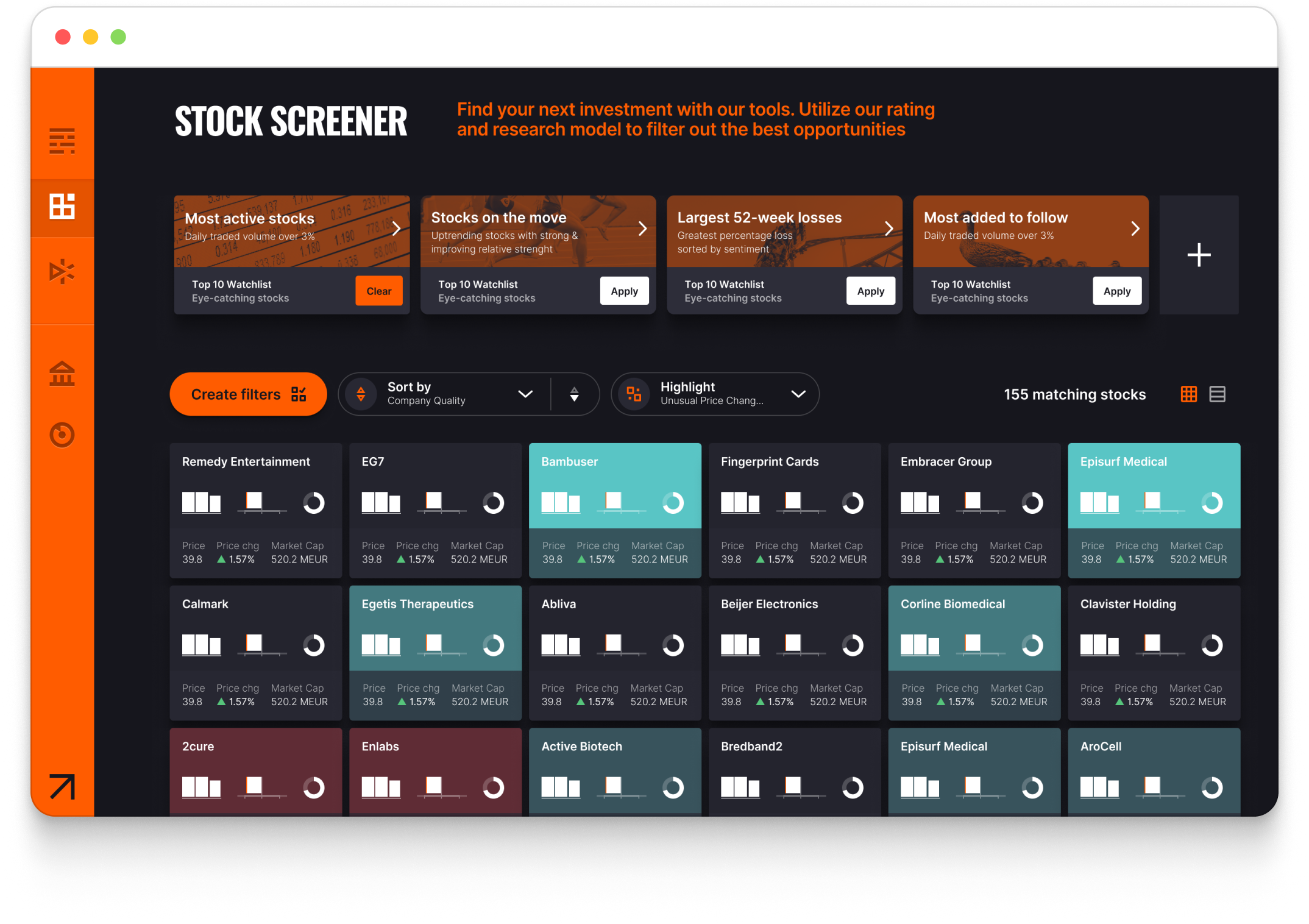

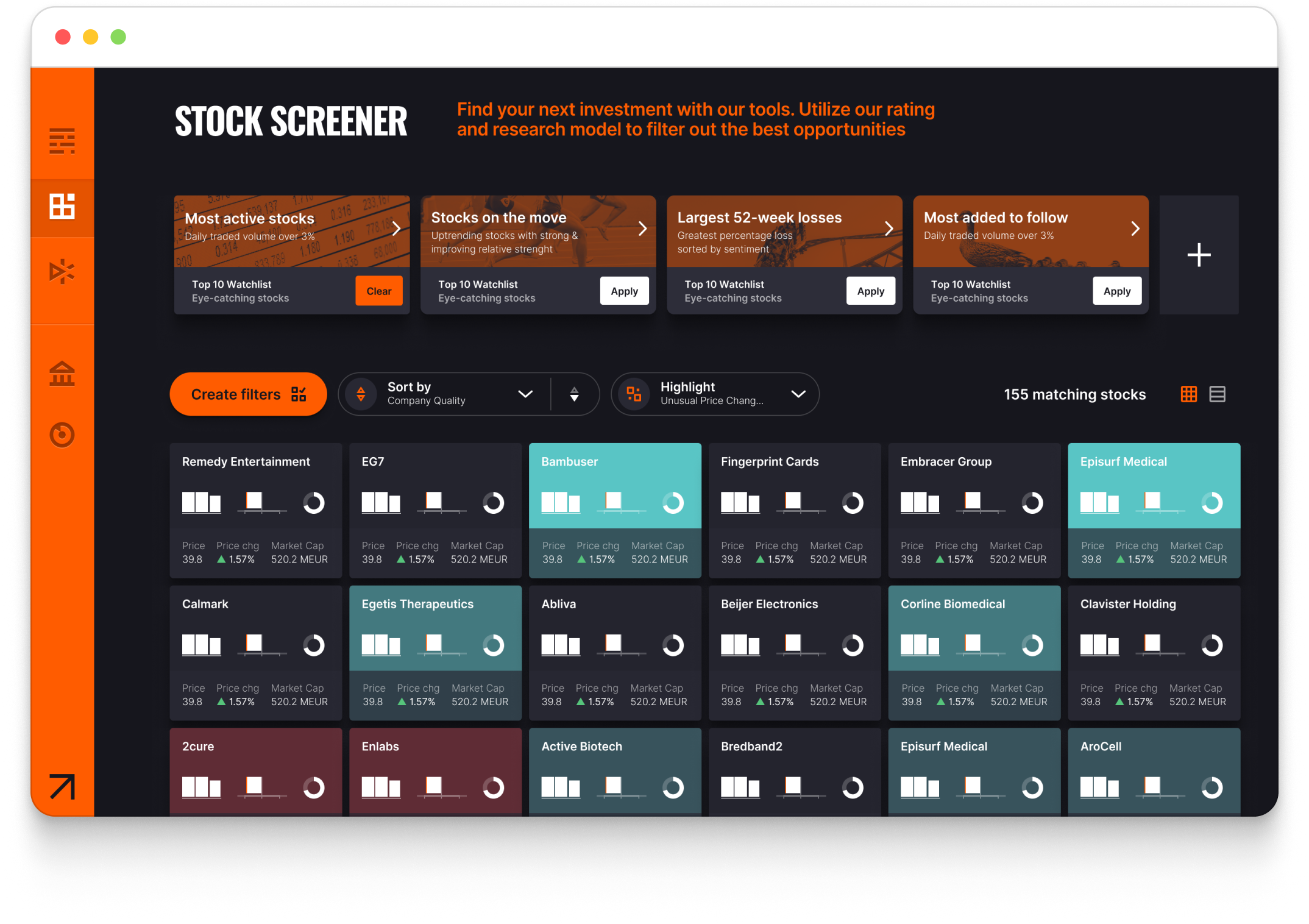

Stock screener with Quality Rating filters

→

Top Picks portfolio (live updates)

→

Ownership, Dividend & Momentum analytics

→

Custom notification system

→

Fund & insider ownership data

→

Short interest tracking

Schedule a consultation

View the full team

Book a briefing

Mäster Samuelsgatan 42, 10th floor

Box 7141, 103 87

Stockholm, Sweden

info@redeye.se+46 (0)8 545 013 30

REDEYE CAPITAL

Get direct access to analysts and company management + structured analysis on 146 Nordic growth companies—with our Quality-First Framework, insider signals, and analyst team insights most investors never see.

Contact us

Professional valuation models, three-scenario analysis, and primary research through channel checks with customers, competitors, and experts. We uncover dynamics before the market does.

Direct analyst contact, facilitated management meetings at 146 companies, and 100+ annual events including our exclusive Serial Acquirers Club.

Quality Rating filters, Top Picks portfolio, ownership analytics, momentum data, and short interest tracking in one integrated platform.

“Redeye are different to other research providers. They are truly long-term focused and think like investors.”

Andrew Strasser, Investment Analyst at Constantia Investment Partners, Australia

Our analysts don't rely on consensus estimates or surface-level metrics. We systematically evaluate what truly drives long-term returns—management quality, competitive moats, and financial durability. This disciplined approach consistently identifies opportunities before they're priced in.

Our systematic approach evaluates 100+ factors across three pillars. Management quality, compensation alignment, innovation capacity, balance sheet health, competitive positioning—nothing escapes our checklist.

Our analysts conduct field research: customer interviews, supplier checks, competitor analysis, industry expert consultations. We piece together non-material information to form material conclusions before the market catches on.

Scenario-based DCF, peer analysis, and sum-of-the-parts models for every company. Three distinct outcomes help you understand risk-reward with precision.

→

Full research archive on all 146 covered companies

→

Proprietary Quality Rating (People, Business, Financials)

→

Quarterly theme reports (Serial Acquirers, SaaS, IT Consulting)

→

Annual sector outlooks (Gaming, Cybersecurity, Life Science)

→

Same-day earnings notes + next-day deep updates

→

Analyst contact for your research questions

→

Corporate access to management teams

→

Priority invitations to in-person conferences

→

Exclusive Serial Acquirers Club membership

→

Priority customer support

→

Stock screener with Quality Rating filters

→

Top Picks portfolio (live updates)

→

Ownership, Dividend & Momentum analytics

→

Custom notification system

→

Fund & insider ownership data

→

Short interest tracking

Schedule a consultation

View the full team

Book a briefing

REDEYE CAPITAL

Mäster Samuelsgatan 42, 10th floor

Box 7141, 103 87

Stockholm, Sweden

info@redeye.se+46 (0)8 545 013 30

Get direct access to analysts and company management + structured analysis on 146 Nordic growth companies—with our Quality-First Framework, insider signals, and analyst team insights most investors never see.

Contact us

Professional valuation models, three-scenario analysis, and primary research through channel checks with customers, competitors, and experts. We uncover dynamics before the market does.

Direct analyst contact, facilitated management meetings at 146 companies, and 100+ annual events including our exclusive Serial Acquirers Club.

Quality Rating filters, Top Picks portfolio, ownership analytics, momentum data, and short interest tracking in one integrated platform.

“Redeye are different to other research providers. They are truly long-term focused and think like investors.”

Andrew Strasser, Investment Analyst at Constantia Investment Partners, Australia

Our analysts don't rely on consensus estimates or surface-level metrics. We systematically evaluate what truly drives long-term returns—management quality, competitive moats, and financial durability. This disciplined approach consistently identifies opportunities before they're priced in.

Our systematic approach evaluates 100+ factors across three pillars. Management quality, compensation alignment, innovation capacity, balance sheet health, competitive positioning—nothing escapes our checklist.

Our analysts conduct field research: customer interviews, supplier checks, competitor analysis, industry expert consultations. We piece together non-material information to form material conclusions before the market catches on.

Scenario-based DCF, peer analysis, and sum-of-the-parts models for every company. Three distinct outcomes help you understand risk-reward with precision.

→

Full research archive on all 146 covered companies

→

Proprietary Quality Rating (People, Business, Financials)

→

Quarterly theme reports (Serial Acquirers, SaaS, IT Consulting)

→

Annual sector outlooks (Gaming, Cybersecurity, Life Science)

→

Same-day earnings notes + next-day deep updates

→

Analyst contact for your research questions

→

Corporate access to management teams

→

Priority invitations to in-person conferences

→

Exclusive Serial Acquirers Club membership

→

Priority customer support

→

Stock screener with Quality Rating filters

→

Top Picks portfolio (live updates)

→

Ownership, Dividend & Momentum analytics

→

Custom notification system

→

Fund & insider ownership data

→

Short interest tracking

Schedule a consultation

View the full team

Book a briefing

Mäster Samuelsgatan 42, 10th floor

Box 7141, 103 87

Stockholm, Sweden

info@redeye.se+46 (0)8 545 013 30

REDEYE CAPITAL